An independent and self-sufficient steel supply chain is a vital strategic economic asset.

The most significant thing governments can do to assist Australia’s steel industry is ensure full and fair access to tax payer-funded construction and infrastructure projects.

Increasing steel tonnage through the local supply chain will improve utilisation levels within the industry and underpin its viability. Use of locally milled and locally fabricated steel is critical to the industry and in the best interests of Australia’s economy.

Businesses in the local steel value chain have been operating within a free market environment for several decades and are accustomed to working within the current trade regime of only minor or no tariffs on imported steels.

The Australian Steel Institute (ASI) understands that the businesses in the Australian value chain must be competitive but believes that it can compete against international supply if given a level playing field.

The ASI advocates a structured and transparent approach to local participation policy so that procurement decisions are based on:

The ASI embraces local participation policies that call for Full, Fair and Reasonable opportunity for local industry to compete on an equal footing.

The ASI advocates:

The ASI does not advocate any wholesale legislative mandating of specific levels of local content for steel.

We support free and fair trade and believe that the best way forward is for industry and government to work cooperatively to secure the best economic outcomes for the country.

The Australian steel supply chain employs over 100,000 people and generates revenues in the order of $29 billion annually. It has an unusually high multiplier effect – that is, as many as six workers are employed in related industries for each person employed in the steel industry.

As a result, a strong Australian steel industry has a significant stimulus effect on the wider economy. BIS Shrapnel estimates that if Australian state and Commonwealth governments were to substitute imports with locally milled and fabricated steel, there would be a relatively small increase in cost of 0.2%, or $60–80m. The resulting upside to Australia’s economy would outstrip the investment 15 to 20-fold, returning up to $1.3 billion to the economy in GDP growth.

(Benefits of a Government Procurement Program for Local Steel Content_Final Report BIS Shrapnel Australian Workers Union 2015)

In recent years the volumes of imported steel and fabricated steel products have increased markedly.

Globally, the steel industry is facing headwinds driven by overcapacity and a rise in protectionism. These factors have resulted in an increase in the dumping of marginally costed steel and fabricated steel onto global export markets, creating stresses across the industry.

In Australia, the local steel supply chain is often disadvantaged in supplying taxpayer-funded infrastructure and construction projects because they are not tendered on an equal footing with competition from international imports. There are two key issues:

Australia’s steel value chain has been operating within a free market environment for decades and is accustomed to working within the current trade regime of only minor or no tariffs on imported steels. The ASI understands that the Australian value chain must be competitive and believes that, if given a level playing field against international supply, it can compete. The ASI advocates for free and fair competition.

The ASI supports a rules-based system to ensure free and fair trade, believes there are mechanisms within the current system to address this and advocates the inclusion of procurement guidelines that consider the the economic and social benefits that result from using the domestic supply chain.

There is a great opportunity for policy makers to boost the Australian economy with government procurement guidelines that recognise the economic and social benefits that result from using the domestic supply chain.

By adopting procurement policies that better consider the whole-of-life costs of procurement, as well as the employment and economic benefits of local supply, governments can significantly increase the level of local content in infrastructure projects.

It should be noted that local procurement policies exist in the US, UK, Canada and other countries.

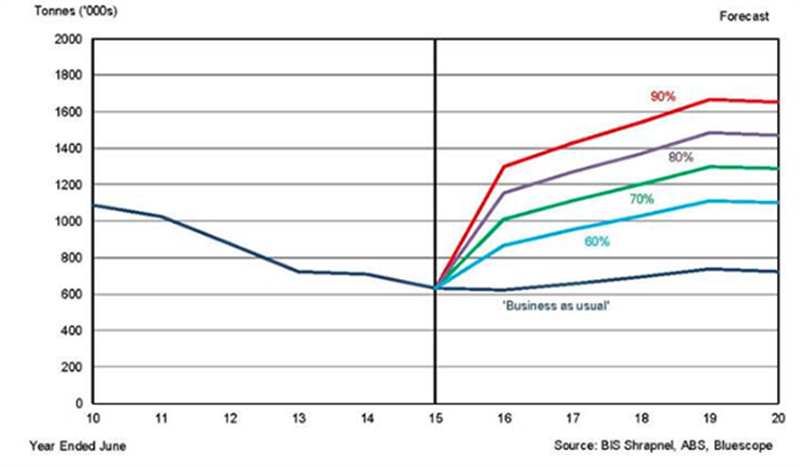

Chart: Domestic steel usage in government projects under alternative scenarios:

Increasing the domestic share of steel content in government projects from below 60% to 90% would grow the size of the market for Australian steel from 633,000 tonnes currently to a peak of approximately 1.5 million tonnes in 2018/19 and 2019/20.

A concerted effort by federal and state governments to achieve a 90% domestic share of steel content in government projects would increase local steel supply by 3.4 million tonnes in total over the next five years, an average of 690,000 tonnes per annum, contributing $4.3 billion to real GDP over the next five years, assuming an average steel price of $1270/t. This price is 10% higher than the projected average import price, in line with Canada’s local content policy.

Some of this will be offset by additional cost to government budgets. We believe a shift to 90% local content will absorb the excess domestic capacity, which, in turn, will be sufficient to support the ongoing viability of the local steel industry. Such a shift would add up to $80 million per annum to government budgets, assuming that domestic prices are at least 10% higher than import prices. If we assume that domestic prices are 20% more, then the additional cost rises to as much as $160 million per annum.

Investment is needed in infrastructure development to meet the needs of Australia’s rapidly growing population, underpin economic growth and unlock and increase productivity, competitiveness, innovation and investment in the economy.

Infrastructure development creates jobs in construction and, subsequently, in operation. Local jobs generate payroll tax for state governments, training and apprenticeship opportunities for young people and for retraining workers and deliver social benefits that come from economic growth and employment.

The domestic construction industry and the steel value chain will benefit from this nation-building infrastructure development if we maximise the local share of steel content in construction. The ASI advocates policy positions that maximise the potential for local industry to participate in this infrastructure investment, optimise the delivery of much-needed infrastructure projects and remain consistent with Australia’s international trade obligations.

The ASI advocates the implementation of procurement policies that recognise the economic and social opportunity to small- and medium-sized enterprises (SMEs) in the value chain and give this a greater weighting in the tender assessment for government projects because:

The ASI advocates the implementation of its State Government Steel Initiative. The initiative is based on three main objectives:

The Infrastructure Sustainability Council of Australia (ISCA) also recognises the potential sustainability benefits of steel. IS rating points are awarded for reducing the lifecycle environmental impact of materials used and to encourage the procurement of material with environmental product labels, such as an EPD.

While most government investment in infrastructure is enacted at a state level, there are some notable exceptions including the Inland Rail project, Snowy Hydro 2 and the NBN. The ASI advocates that these projects and other federal funds provided to the states be hard-linked to similar policy settings via Industry Participation Plans. Grant applications must clearly demonstrate the economic and social benefit.

General economic benefit

All government tenders should consider and be assessed on the economic benefit. Tenderers are required to demonstrate the economic and social value created via the domestic value chain. An Industry Participation Plan submitted with the tender should highlight the benefits in terms of economic value-add to the economy (e.g. job creation, taxes paid, etc.). This statement should be given a weighting of 20% in final consideration of applications.

Awarding government tenders on this basis will optimise the multiplier effect of government infrastructure and construction, continuing to drive economic growth and jobs.

Steel projects are made up of a group of products requiring additional focus – when work packages are released, special scrutiny should apply. Contracts are to be awarded based on a commitment to the contribution to economic benefit. If, in the work package review stage, the steel component does not represent an equal contribution to the economic benefit ratio, then the contractor is to be called to account – i.e. the contractor can’t import the steel and increase labour somewhere else such as in the civil works. To maximise the economic benefit, we need to apply the weighting to locally milled and locally fabricated steel.

Quality & Environmental Benchmark

A specific set of rules be implemented for all government-funded projects requiring: